EUR/CHF Looks Set For a Bullish Reversal: How to Take Advantage of the Opportunity

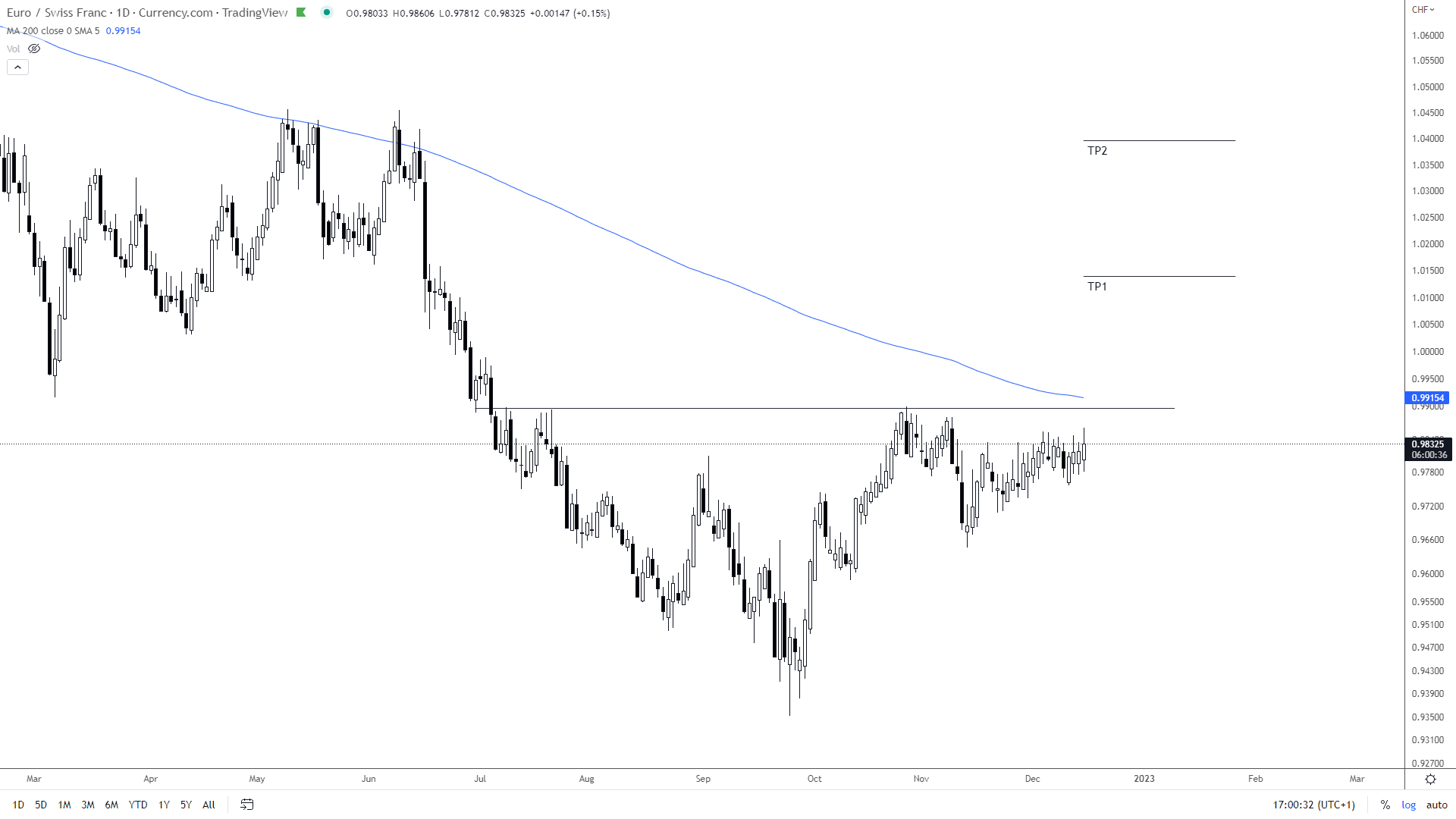

The EUR/CHF forex pair has been in a state of consolidation from July to December. On the daily chart, a figure that resembles both a head and shoulders formation and a cup and handle can be observed.

What is more important for traders than the classification of this figure is the clearly defined horizontal boundary near the price of 1.00.

In addition to the important psychological resistance level of 1.00, the presence of the descending 200 Moving Average gives traders an additional indication that EUR/CHF could break above both MA and the horizontal boundary at the same time. This would signal a strong bullish signal, making it a prime opportunity to long the pair.

Obviously, if this breakout happens, that’s where I would buy EUR/CHF.

I would set the stop loss below the line and leave some wiggle room for the position to move.

Take profit points are visible on the chart. TP1 corresponds to the distance from the horizontal boundary to the bottom of the figure on the left side. TP2 represents the distance from the horizontal boundary to the bottom of the figure.

If you like this trading idea, you can buy EUR against CHF on Currency.com.