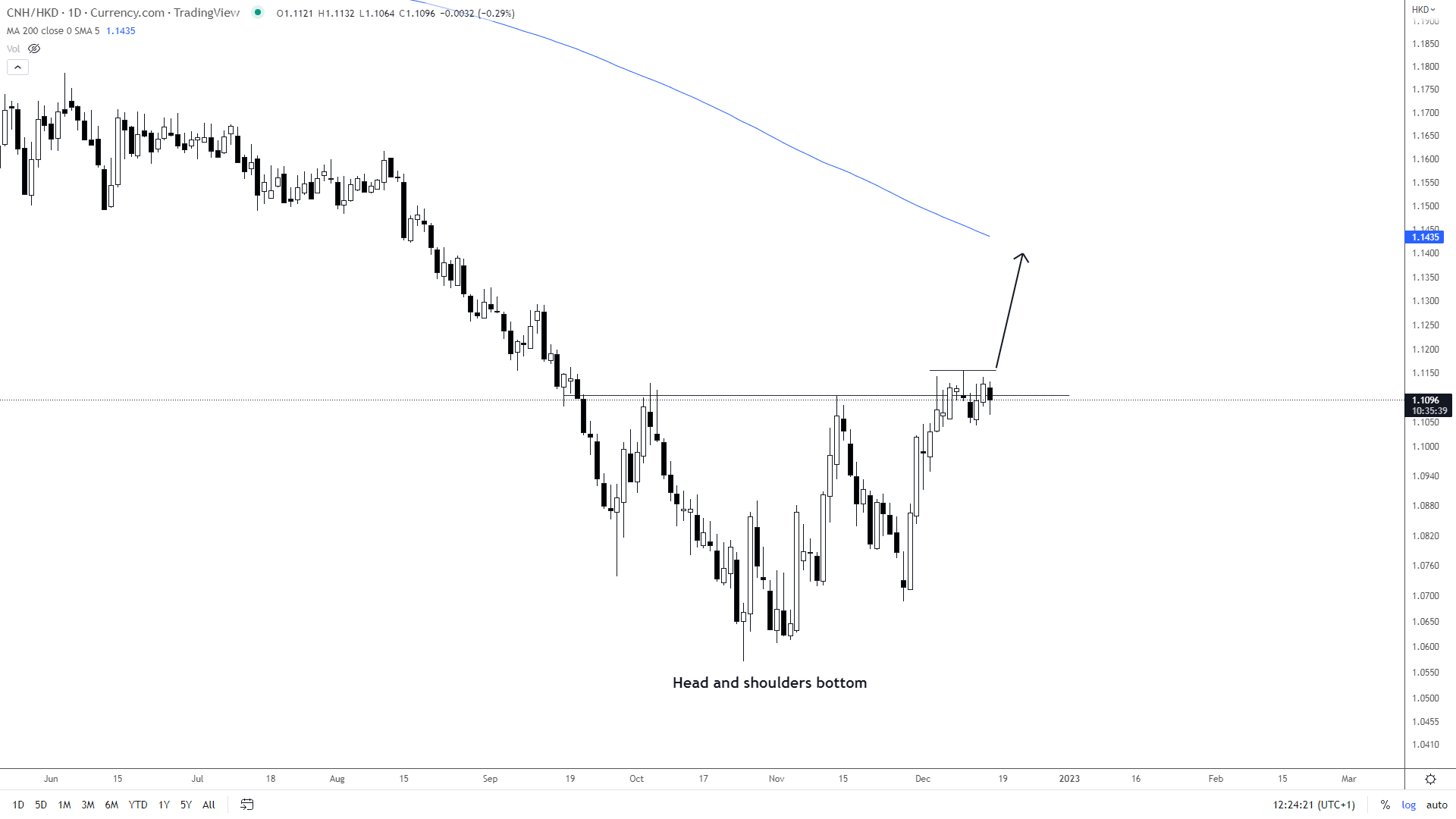

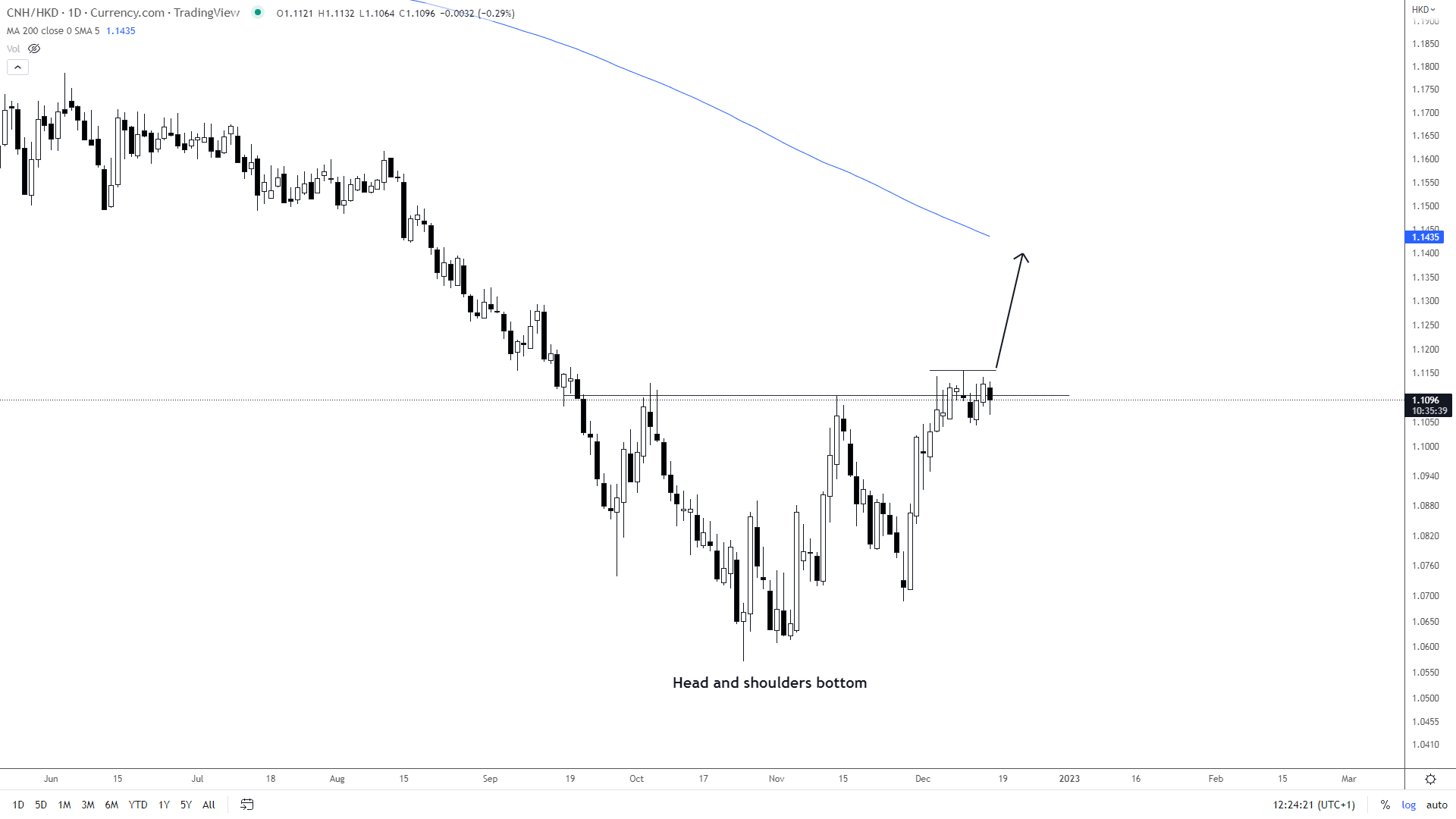

Head and Shoulders Bottom in CNH/HKD

Currency trading has been particularly volatile for the Chinese Yuan-Hong Kong Dollar (CNH/HKD) currency pair in the past few weeks. After a steep drop in the exchange rate that began in April, the pair began to consolidate at the end of September.

Several jumps and falls happened since then, and a head and shoulders bottom was formed on the chart with a nice horizontal line at a bit above 1.10.

Head and shoulder bottom is one of the strongest reversal patterns and I am preparing to open a long position.

The price has been consolidating around the horizontal line itself for several days, which is also bullish.

I will place a stop-buy order above this consolidation zone above (the smaller horizontal line on the chart).

However, the price is currently below the 200 MA on the daily chart and that is what is not bullish. Therefore my take profit point would be somewhere around 200 MA.

The stop loss would be placed below the consolidation zone, which gives us a risk-reward ratio of 2.0.

If you’re interested in trading this pair, you can open an account with Currency.com.